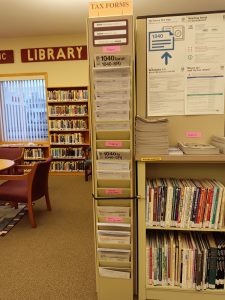

Income Tax Returns and Unemployment Resources

A limited number of forms and instructions are available at the library. We will try to keep a supply of the basic forms on hand and can assist you in finding the instructions online once the hard copies are gone.

Federal

- Limited print forms available at the library. Find forms online and print whatever you need at the library.

Get forms online or request they be mailed to you:

- Internal Revenue Service – https://www.irs.gov/ or call (800)-829-1040

Common Forms & Instructions:

- Instructions 1040/1040 SR

- Form 1040

- Form 1040 Schedules 1, 2, 3

- Form 1040-SR

- Form W-9

- Instructions for Form W-9

- Form W-4

Wisconsin

Limited print forms are available at the Library. Find forms online and print whatever you need at the library.

Get forms online or request they be mailed to you:

- Wisconsin Department of Revenue at http://www.revenue.wi.gov or

(608) 266-2772 or (414) 227-4000

Common Forms & Instructions

- Rent Certificate Fill-In Form

- Schedule H Homestead Credit Claim Fill-In Form

- Schedule H/H-EZ – Instruction Booklet

- Form 1 – Form– Income Tax Return Fill-In Form

- Form I – Instructions- Income Tax Return Instructions

- Form 1NPR – Form – Nonresident & Part-Year Resident Income Tax

- Form 1NPR – Instructions– Nonresident and Part-Year Resident Income Tax Return Instructions

- Schedule WD – Instructions – Capital Gains and Losses

- Schedule WD – Form – Capital Gains and Losses

Unemployment Insurance Tax Information

1099-G Tax Information provided by the Wisconsin Department of Workforce Development

1099-G Tax information – https://dwd.wisconsin.gov/uiben/1099.htm

Why do I need a 1099-G tax form?

- Unemployment insurance benefits are taxable income

What information is on a 1099-G tax form?

- Unemployment benefits paid to you

- Federal and state income taxes withheld from your benefits

- Repayments of overpaid benefits

Where do I get my 1099-G tax form?

- View or print a copy of your current or previous year forms online https://my.unemployment.wisconsin.gov

- Log on using your username and password, then go to the “Unemployment Services” menu to access your 1099-G tax forms

When can I get my 1099-G tax form?

- Information for the most recent tax year will be available online in mid-January: https://dwd.wisconsin.gov/uiben/1099.htm

Who do I ask about how to fill out my Form 1040 or Wisconsin Form 1?

- Internal Revenue Service – https://www.irs.gov/ or call (800)-829-1040

- Wisconsin Department of Revenue at http://www.revenue.wi.gov or

(608) 266-2772 or (414) 227-4000